Affordable AI That Cuts Costs and Scales Your Business Smarter

AI software is no longer optional for accounting and bookkeeping firms. In 2026, rising client expectations, tighter IRS compliance requirements, and increasing labor costs are forcing firms to automate repetitive workflows while improving accuracy.

Whether you run a solo bookkeeping practice, a 5-person CPA firm, or a 40-person regional accounting office, choosing the right AI tools can directly impact:

• Billable hours

• Staff productivity

• Client retention

• Profit margins

• Compliance risk

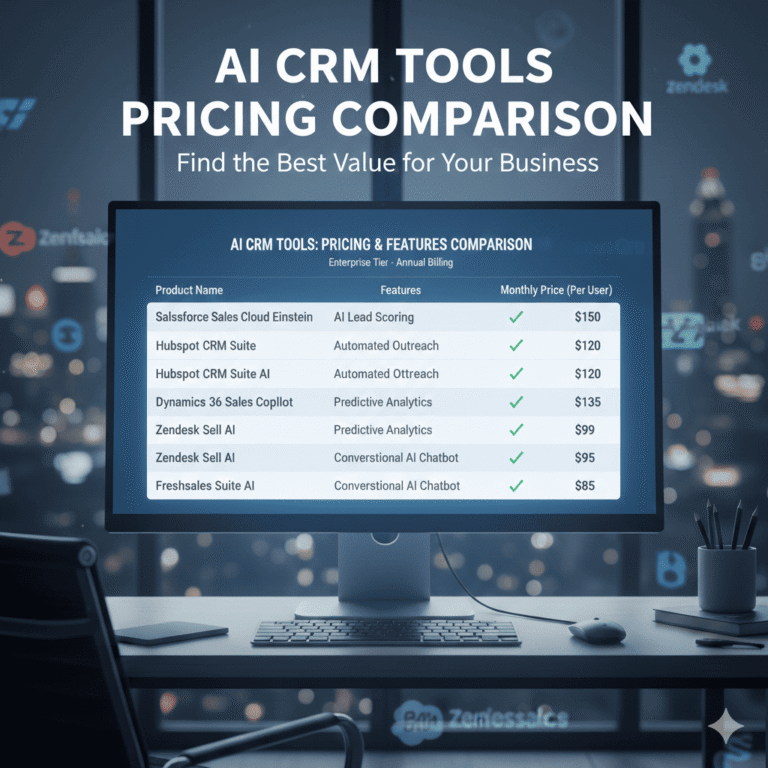

Firms evaluating automation across departments should also review our AI CRM Tools Pricing Comparison for sales and client management software insights.

This guide compares the best AI tools for accounting and bookkeeping firms in the United States, focusing on:

- Pricing transparency

- ROI potential

- Firm size suitability

- Compliance readiness

- Integration with QuickBooks, Xero, and major US tax platforms

Let’s break it down.

Quick Comparison Table: AI Tools for Accounting Firms (2026)

| Tool | Starting Price (Monthly) | Best For | Key Use Case |

|---|---|---|---|

| Vic.ai | Custom ($1500+ est.) | Mid-size firms | AP automation |

| Botkeeper | $69–$299+ | Bookkeeping firms | Automated bookkeeping |

| Dext | $24 | Small firms | Receipt & expense capture |

| Karbon AI | $59/user | CPA teams | Workflow automation |

| Canopy AI | $40/user | Tax firms | Client management + IRS tools |

| Xero AI | $15 | Small businesses | Accounting automation |

| QuickBooks Advanced AI | $200 | Growing firms | Financial reporting |

| Truewind | Custom | Tech startups | AI bookkeeping |

| Taxfyle AI Tools | Custom | Tax firms | On-demand tax work |

| Gusto + AI Payroll | $40 base + $6/user | Firms offering payroll | Payroll automation |

How to Evaluate AI Tools for Accounting & Bookkeeping Firms in 2026

Before selecting any AI software, accounting and bookkeeping firms must evaluate tools through a strategic lens. Not every automation platform is built for financial workflows, and choosing incorrectly can create compliance risk, operational friction, and wasted investment.

Below are the key criteria US-based firms should use when comparing AI accounting tools.

1️⃣ Pricing Structure: Per User vs Per Client vs Volume-Based

AI tools for accounting firms typically fall into three pricing models:

Per User Pricing

Common for workflow and practice management tools like Karbon and Canopy.

Best for:

• CPA firms with defined staff structure

• Firms tracking workload by team member

Watch for:

• Annual billing requirements

• Minimum seat commitments

Per Client Pricing

Common in bookkeeping automation tools like Botkeeper.

Best for:

• Firms with recurring client billing

• Outsourced bookkeeping businesses

Watch for:

• Scaling costs as client count increases

• Volume discounts

Volume-Based Pricing

Often used in accounts payable automation like Vic.ai.

Best for:

• Firms processing thousands of invoices

• Enterprise clients

Watch for:

• Hidden API charges

• Integration fees

Before committing, calculate projected annual cost at full capacity — not just entry-tier pricing.

2️⃣ Integration With US Accounting Ecosystem

Accounting firms in the United States primarily operate within:

• QuickBooks Online

• QuickBooks Desktop

• Xero

• NetSuite

• Gusto

• ADP

• Stripe

• Bill.com

AI tools must integrate cleanly with these systems.

If an AI platform does not sync properly with QuickBooks or Xero, the operational savings disappear.

When evaluating tools, ask:

✔ Does it offer native integration?

✔ Is data synced in real time?

✔ Are reconciliations automatic?

✔ Can reports be exported for IRS audits?

Integration reliability directly impacts ROI.

3️⃣ Compliance & Data Security Standards

Accounting firms handle highly sensitive financial data.

Before adopting any AI solution, verify:

• SOC 2 compliance

• Encryption standards (AES-256 preferred)

• US-based data hosting (if required by client contracts)

• GDPR and CCPA readiness

• IRS publication compliance

Never rely solely on marketing claims. Request official compliance documentation.

4️⃣ Workflow Automation Depth

Some AI tools only automate small tasks like data entry.

Others automate entire workflows.

True workflow automation includes:

• Invoice receipt → Categorization → Approval → Sync

• Client onboarding → Task assignment → Deadline tracking

• Tax document upload → Extraction → Filing checklist

Tools with deeper automation provide exponential time savings.

5️⃣ Advisory & Forecasting Capabilities

The most profitable accounting firms are advisory-driven.

AI tools that include:

• Cash flow forecasting

• Revenue trend analysis

• Profit margin tracking

• Budget simulations

Enable firms to transition from compliance work to strategic consulting.

This dramatically increases client lifetime value.

For deeper forecasting and analytics platforms, explore our AI Tools for Data Analysis guide.

6️⃣ Scalability & Future-Proofing

Choose tools that can scale with your firm.

Questions to consider:

• Can this platform handle 10x invoice volume?

• Does pricing become cost-prohibitive at scale?

• Does it support API access for custom reporting?

• Will it integrate with future ERP systems?

Switching accounting platforms later can disrupt client operations.

Long-term scalability matters more than short-term savings.

7️⃣ Implementation Complexity

Not all AI tools are plug-and-play.

Small firms should prioritize:

• Simple onboarding

• Minimal IT dependency

• Clear training documentation

Mid-size firms may require:

• Dedicated implementation support

• Data migration assistance

• Workflow customization

Implementation time should be factored into ROI projections.

The Real Cost of NOT Using AI in Accounting Firms

Many firms hesitate due to subscription cost concerns.

But consider the alternative.

Manual bookkeeping and tax prep lead to:

• Higher overtime during tax season

• Staff burnout

• Client churn

• Slower turnaround times

• Lower advisory revenue

If automation saves just 10 hours per week:

10 hours × 52 weeks × $85/hour = $44,200 potential annual value.

AI is often an investment in margin expansion — not an expense.

AI Tools vs Hiring Additional Staff: Cost Comparison

Let’s compare.

Hiring a junior accountant:

• Salary: $55,000–$70,000 annually

• Payroll taxes & benefits

• Training costs

• Turnover risk

AI automation stack:

• $6,000–$15,000 annually depending on firm size

While AI does not replace professional expertise, it can reduce the need for additional headcount during peak seasons.

For many firms, automation delays hiring by 1–2 years.

Key Questions to Ask Before Purchasing

Before signing any contract, firm partners should ask:

- What workflow are we trying to automate?

- What is our expected monthly time savings?

- How will we measure ROI?

- What compliance documentation is available?

- How difficult is it to migrate away later?

- Does this tool support our advisory strategy?

Clarity before adoption prevents overspending.

Summary: Smart Evaluation Before Selection

AI tools for accounting and bookkeeping firms vary widely in pricing, complexity, and value.

The right tool depends on:

• Firm size

• Client type

• Revenue model

• Compliance needs

• Advisory ambitions

In the next section, we break down the best AI tools for accounting firms in the United States, including pricing, use cases, and which type of firm each tool is best suited for.

Let’s examine them one by one.

1️⃣ Vic.ai — AI Accounts Payable Automation

Best for: 10+ employee accounting firms

Vic.ai uses machine learning to automate invoice coding, approvals, and reconciliation.

Pricing

Custom pricing. Typically starts around $1,500 per month depending on invoice volume.

Why It Matters

• Reduces AP processing costs by up to 60%

• Improves audit trail documentation

• Minimizes manual data entry errors

ROI Example

If your firm processes 3,000 invoices monthly and spends 2–3 minutes per invoice, automation can save 100+ hours monthly.

At $75/hour billable rate, that’s $7,500+ productivity value.

2️⃣ Botkeeper — AI-Powered Bookkeeping

Best for: Small to mid-size bookkeeping firms

Botkeeper combines machine learning with human oversight to automate reconciliations and transaction categorization.

Pricing

Starts around $69 per client per month. Higher tiers scale into $299+ range.

Ideal Use Case

• Firms managing 20–200 recurring bookkeeping clients

• Outsourced bookkeeping providers

• Firms needing scalable automation

Botkeeper integrates with QuickBooks and Xero, making it practical for US bookkeeping businesses.

3️⃣ Dext — Receipt & Expense Automation

Best for: Solo CPAs and small firms

Pricing

Starts at $24 per month.

What It Does

• Captures receipts automatically

• Extracts line-level expense data

• Syncs with accounting software

This tool reduces client back-and-forth during tax season and improves documentation accuracy.

4️⃣ Karbon AI — Workflow & Practice Management

Best for: 5–50 person accounting firms

Karbon is a practice management system enhanced with workflow automation and AI task routing.

Pricing

Starts at $59 per user per month.

Why It’s Valuable

• Assigns tasks based on workload

• Automates recurring deadlines

• Improves team visibility

Accounting firms often lose revenue due to missed follow-ups. Automation protects recurring billing.

5️⃣ Canopy AI — Tax Resolution & Client Management

Best for: Tax-heavy CPA firms

Pricing

Starts at $40 per user per month.

Key Strength

• IRS transcript retrieval

• Tax resolution tracking

• Secure client communication

For firms handling IRS disputes or tax resolution cases, automation reduces risk and improves documentation accuracy.

6️⃣ QuickBooks Advanced AI

Best for: Growing firms managing mid-sized clients

Pricing

Starts around $200 per month.

AI Features

• Automated cash flow forecasting

• Revenue trend detection

• Smart reporting

If your firm advises small businesses, predictive reporting increases advisory revenue potential.

7️⃣ Xero AI

Best for: Startup-focused accounting firms

Pricing

Starts at $15 per month.

Value Proposition

• Automated bank reconciliation

• Real-time reporting

• Smart invoice matching

Great for firms serving startups and small ecommerce brands.

8️⃣ Truewind — AI for Tech Startups

Best for: VC-backed startup accounting

Pricing

Custom.

Truewind automates bookkeeping specifically for startups using Stripe, Brex, Ramp, and SaaS stacks.

This is a niche but high-margin for firms serving tech clients.

9️⃣ Gusto AI Payroll Automation

Best for: Firms offering payroll services

Pricing

$40 base + $6 per employee.

Payroll automation reduces compliance errors and recurring administrative tasks.

If your firm also manages HR or payroll advisory, see our AI Tools for HR Managers comparison.

🔟 Taxfyle AI

Best for: Firms needing seasonal capacity

Taxfyle allows firms to outsource overflow tax work.

Helps during tax season surge without hiring full-time staff.

How to Choose the Right AI Tool for Your Accounting Firm

1️⃣ Firm Size

Solo CPA

Focus on Dext + QuickBooks automation.

5–10 Staff Firm

Consider Karbon + Botkeeper.

20+ Staff Firm

Evaluate Vic.ai or enterprise-grade automation.

2️⃣ Revenue Model

Compliance-focused firm

Prioritize automation + audit trails.

Advisory-focused firm

Choose tools with forecasting and predictive reporting.

3️⃣ Client Type

Startup clients

Truewind + Xero.

Traditional SMB clients

QuickBooks + Dext.

High-net-worth or IRS cases

Canopy.

ROI Calculation Example for a 10-Person CPA Firm

Assume:

• 300 monthly recurring bookkeeping clients

• 2 hours saved per client monthly

• $85 average billable rate

Savings:

300 × 2 hours × $85 = $51,000 productivity capacity monthly.

Even if only 25% converts to billable work, that’s $12,750 potential revenue uplift.

Automation is not cost — it is margin expansion.

Cost vs Benefit Analysis: Small vs Mid-Size Firms

Solo Bookkeeper (1–2 People)

Average revenue: $120,000–$250,000 annually

Main pain: time overload

Recommended stack:

• Dext ($24)

• QuickBooks AI ($200 if needed)

Expected monthly savings: 20–30 hours

Value: $1,500–$2,500 time savings per month

5–10 Person CPA Firm

Average revenue: $750,000–$2M annually

Main pain: workflow coordination + tax season surge

Recommended stack:

• Karbon ($59/user)

• Botkeeper ($69–$299/client)

• Canopy ($40/user)

Estimated automation impact:

• 25–35% workflow acceleration

• Reduced overtime during tax season

20+ Person Firm

Average revenue: $5M+

Main pain: scaling without hiring

Recommended stack:

• Vic.ai

• Enterprise workflow automation

• Predictive forecasting tools

Enterprise AI reduces labor expansion while increasing client capacity.

Compliance & Security Considerations

Accounting firms must evaluate:

• SOC 2 certification

• Data encryption standards

• IRS data handling policies

• Client portal security

Never adopt AI tools without verifying US data compliance standards.

Deep Dive: AI in Tax Season Automation (Critical Revenue Lever)

Tax season is the most intense operational period for US accounting firms.

Common bottlenecks:

• Missing client documents

• Manual data extraction

• IRS transcript delays

• Staff burnout

AI can:

✔ Extract data from W-2s and 1099s

✔ Auto-organize client documents

✔ Flag inconsistencies

✔ Forecast filing workload

If your firm processes 500 returns per season and saves 20 minutes per return:

500 × 20 minutes = 10,000 minutes

= 166 hours saved

At $90/hour effective billing value → $14,940 seasonal productivity impact.

Client communication automation during tax season can also benefit from tools featured in our AI Tools for Customer Support guide.

AI + Advisory Services: The Real Revenue Multiplier

Many firms still operate in compliance mode.

The real money is in advisory.

AI forecasting tools enable:

• Cash flow projection

• Profitability modeling

• Scenario analysis

• Budget forecasting

If you convert just 10 bookkeeping clients into advisory retainers at $750/month:

10 × $750 = $7,500 recurring revenue.

Automation frees capacity for higher-value advisory work.

Many of these platforms also appear in our AI Tools for Small Businesses Under $100 guide for cost-conscious firms.

Pricing Breakdown: What Firms Actually Pay Annually

Let’s model realistic annual cost ranges.

Small Firm Stack Example

Dext: $24 × 12 = $288

QuickBooks Advanced: $200 × 12 = $2,400

Karbon (5 users): $59 × 5 × 12 = $3,540

Total annual investment: ~$6,200

If this saves 10 hours/week at $80/hour:

10 × 52 × $80 = $41,600 productivity capacity

Return far exceeds cost.

Mid-Size Firm Stack Example

Karbon (15 users): ~$10,620 annually

Botkeeper (100 clients avg $100): ~$120,000 annually

Canopy (10 users): ~$4,800

Total: ~$135,000 annually

If firm revenue increases from 3M to 3.6M via efficiency and upsells, automation pays for itself.

Risk Management & AI Governance for Accounting Firms

Because accounting deals with financial data, AI adoption must be governed carefully.

Firms should implement:

• Internal AI usage policies

• Client disclosure statements

• Data encryption verification

• Vendor security audits

Important: Always verify SOC 2 compliance before onboarding enterprise AI tools.

AI Tools by Accounting Specialization

Bookkeeping-Focused Firms

Prioritize:

• Botkeeper

• Dext

• QuickBooks AI

Tax-Heavy Firms

Prioritize:

• Canopy

• Taxfyle

• AI document extraction tools

Audit Firms

Prioritize:

• Predictive analytics

• Fraud detection AI

• Automated anomaly detection tools

Startup-Focused Firms

Prioritize:

• Truewind

• Xero AI

• SaaS expense automation

Competitive Advantage: AI as a Differentiator

Clients increasingly compare firms based on:

• Technology stack

• Reporting speed

• Transparency

• Advisory capabilities

Marketing your firm as “AI-powered accounting” can:

✔ Increase client acquisition

✔ Justify higher pricing

✔ Attract tech-forward businesses

Implementation Roadmap for Accounting Firms

Adopting AI should be phased.

Phase 1: Identify Bottleneck

Choose one repetitive workflow.

Phase 2: Pilot With 10 Clients

Measure:

• Time saved

• Error reduction

• Client feedback

Phase 3: Expand Across Firm

Train staff and document processes.

Phase 4: Upsell Advisory Services

Leverage freed capacity for higher-value offerings.

Best AI Tool by Firm Type

Solo Bookkeeper → Dext

Small CPA Firm → Botkeeper

Mid-size Firm → Karbon

Enterprise Firm → Vic.ai

Tax-heavy Firm → Canopy

Startup-focused Firm → Truewind

Why Accounting Firms Are Rapidly Adopting AI in 2026

The accounting industry in the United States is undergoing structural change.

Three forces are driving AI adoption:

1️⃣ Labor Shortage

The AICPA reports a continuing decline in accounting graduates. Many firms struggle to hire junior staff while workload continues to grow.

AI fills operational gaps without increasing payroll.

2️⃣ Margin Compression

Clients expect:

- Fixed-fee pricing

- Faster turnaround

- Real-time dashboards

- Advisory insights

Firms that rely purely on manual bookkeeping face shrinking margins.

Automation protects profit.

3️⃣ Compliance Complexity

New reporting requirements, sales tax automation, payroll rules, and IRS documentation standards increase administrative burden.

AI tools reduce compliance errors and audit exposure.

Where AI Creates the Most Impact in Accounting Firms

Before choosing tools, identify where automation produces the highest ROI.

Accounts Payable Automation

Manual invoice coding wastes time and introduces errors. AI categorizes and routes invoices instantly.

Bank Reconciliation

Smart reconciliation reduces mismatched transactions and month-end backlog.

Payroll Processing

AI reduces tax miscalculations and filing penalties.

Tax Preparation

Automated document extraction reduces data entry.

Advisory Reporting

Predictive analytics allows firms to upsell financial forecasting.

Future of AI in Accounting (2026–2030 Outlook)

Expect rapid evolution in:

Real-Time AI Audit Assistance

Continuous compliance monitoring.

AI-Powered Fraud Detection

Automated anomaly flagging.

Voice-Based Financial Queries

Clients asking financial dashboards via voice AI.

Hyper-Personalized Tax Optimization

AI suggests tax strategies in real-time.

Firms that delay adoption risk falling behind competitors offering faster turnaround and advisory insights.

Common Mistakes Accounting Firms Make When Adopting AI

❌ Buying too many tools at once

❌ Ignoring training

❌ Over-automating client communication

❌ Failing to verify compliance standards

❌ Not calculating ROI

AI is most powerful when implemented strategically, not impulsively.

Frequently Overlooked Revenue Opportunities With AI

• Packaging AI-enhanced monthly reports

• Offering “AI-powered forecasting” as a premium service

• Bundling payroll + bookkeeping automation

• Offering virtual CFO services

Automation increases capacity. Capacity enables expansion.

Final Strategic Recommendation

If you are unsure where to begin:

Start with expense automation (Dext).

Then add workflow management (Karbon).

Then layer forecasting or advisory AI.

Do not attempt enterprise automation on day one.

Build stack maturity gradually.

For deeper comparisons, explore:

AI Tools for Email Marketing

AI Tools for Customer Support

AI Tools for Data Analysis

AI Tools for HR Managers

These guides provide more function-specific comparisons.

Frequently Asked Questions

Are AI accounting tools IRS-compliant?

Most major tools follow US data security standards, but firms must verify compliance before deployment.

Can AI replace bookkeepers?

No. AI automates repetitive reconciliation tasks but does not replace professional judgment.

How long does implementation take?

Small tools like Dext can be implemented within a day.

Enterprise tools may require 2–4 weeks.

Is AI worth it for firms under $500K revenue?

Yes. Even saving 10–15 hours monthly offsets subscription costs.

Final Thoughts

AI adoption in accounting is no longer experimental. It is a competitive necessity.

Firms that automate:

• Increase margins

• Improve compliance

• Deliver faster reporting

• Reduce burnout

• Scale without proportional hiring

In 2026, the firms that thrive will not be those with the largest teams — but those with the smartest automation stack.

If you run an accounting or bookkeeping firm in the United States, start with one workflow:

Invoice processing

Reconciliation

Payroll

Tax prep

Client communication

Automate it. Measure ROI. Expand from there.

Your margin depends on it.